This is the last of a three-part series covering what I call The Five Financial Mysteries. In the first two articles, the first three Mysteries were revealed about the relationship between cash, accounting, and profit.

This is the last of a three-part series covering what I call The Five Financial Mysteries. In the first two articles, the first three Mysteries were revealed about the relationship between cash, accounting, and profit.

In this article, I’ll complete my attempt to help you stay on the right side of the business survival/failure statistics. So, buckle up as I reveal Financial Mysteries Four and Five.

Financial Mystery Number Four

You can get squeezed between vendors and customers.

Vendors and customers are the prime entities every business deals with financially every day the business is open. Understanding your relationship between these two, (literally between, because your business is in the middle), is the key to cash flow management. The way to avoid getting squeezed is [Continue Reading]

Right now, and likely for a while longer, there’s a lot of stuff coming out about challenges in the U.S. banking system. Sometimes it’s difficult to sort through the range of comments, from the smart to the stupid. But if you’ll give me five minutes, we’ll find some clarity so you can not only make better banking decisions for yourself and your business, but also for our country.

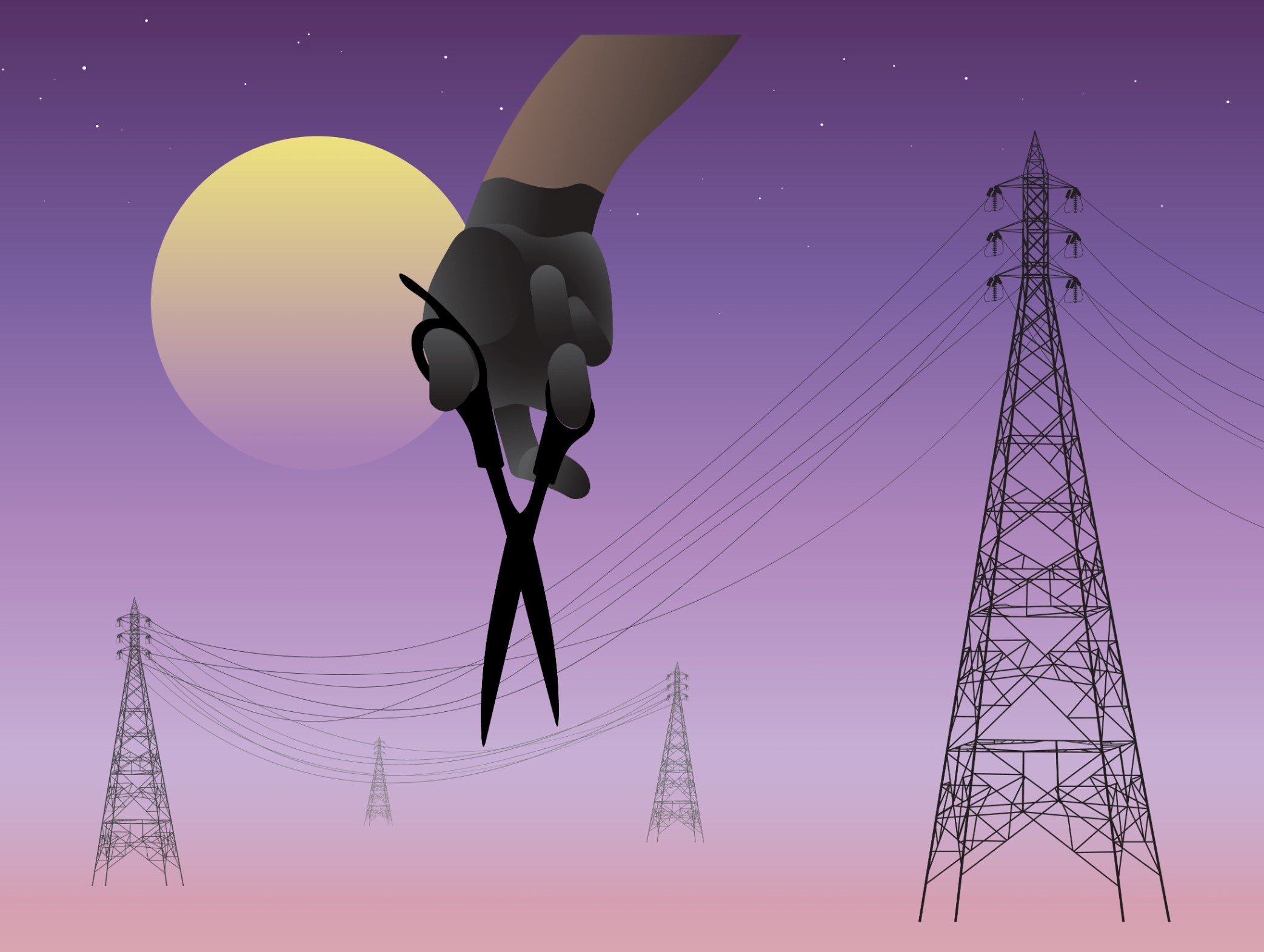

Right now, and likely for a while longer, there’s a lot of stuff coming out about challenges in the U.S. banking system. Sometimes it’s difficult to sort through the range of comments, from the smart to the stupid. But if you’ll give me five minutes, we’ll find some clarity so you can not only make better banking decisions for yourself and your business, but also for our country. This year marks an ignominious 20th anniversary. On August 13, 2003, a single outage in the electric grid cascaded across eight northeastern states, putting 55 million people in the dark for days, and thousands of businesses out of business. The Great Blackout of ’03 was a catastrophic reminder that we’re all one nosy squirrel in a transformer away from an instantaneous, put-you-out-of-business event.

This year marks an ignominious 20th anniversary. On August 13, 2003, a single outage in the electric grid cascaded across eight northeastern states, putting 55 million people in the dark for days, and thousands of businesses out of business. The Great Blackout of ’03 was a catastrophic reminder that we’re all one nosy squirrel in a transformer away from an instantaneous, put-you-out-of-business event. In a column a few weeks ago, I pointed out that every business, including small ones, has assignments that can only be performed by the Chief Executive Officer (CEO). In that article, I covered two of those Big Jobs:

In a column a few weeks ago, I pointed out that every business, including small ones, has assignments that can only be performed by the Chief Executive Officer (CEO). In that article, I covered two of those Big Jobs: This is another offering in my ongoing series on understanding the fundamentals of business as we become better business managers. Remember, fundamentals are like natural laws: they don’t change; they’re the same for everyone, and you can’t succeed without understanding and respecting them. The fundamentals today are all about funding growth.

This is another offering in my ongoing series on understanding the fundamentals of business as we become better business managers. Remember, fundamentals are like natural laws: they don’t change; they’re the same for everyone, and you can’t succeed without understanding and respecting them. The fundamentals today are all about funding growth. “There is a time for everything, and a season for every purpose under heaven.”

“There is a time for everything, and a season for every purpose under heaven.”