This is another offering in my ongoing series on understanding the fundamentals of business as we become better business managers. Remember, fundamentals are like natural laws: they don’t change; they’re the same for everyone, and you can’t succeed without understanding and respecting them. The fundamentals today are all about funding growth.

This is another offering in my ongoing series on understanding the fundamentals of business as we become better business managers. Remember, fundamentals are like natural laws: they don’t change; they’re the same for everyone, and you can’t succeed without understanding and respecting them. The fundamentals today are all about funding growth.

Consider the following scenario that plays out on Main Street every day:

“Finally, my business is growing,” a small business owner confides to his friend, “but why is it creating so much negative cash?” And then, with that deer-in-the-headlights look, he completes his report, “I thought by now, with increased sales, cash would be the least of my worries. I used to be afraid I couldn’t grow my business; now I’m worried it will collapse from growth.”

This entrepreneur’s lament is one of the great ironies of the marketplace: a small business in danger of failure succeeding itself right out of business.

Beware Blasingame’s 2nd Law of Small Business: It’s redundant to say, “undercapitalized small business.” This maxim is especially true for fast-growing companies because revenue growth depletes cash in two dramatic but predictable ways. [Continue Reading]

Whether it’s a year where something we once knew as “normal” was part of our reality, or during an unprecedented and unimaginable year of a global pandemic, the abiding management question for all small business owners is always valid: “What’s the best use of my time right now?” And at no other time of the year are we more time-management challenged than in December.

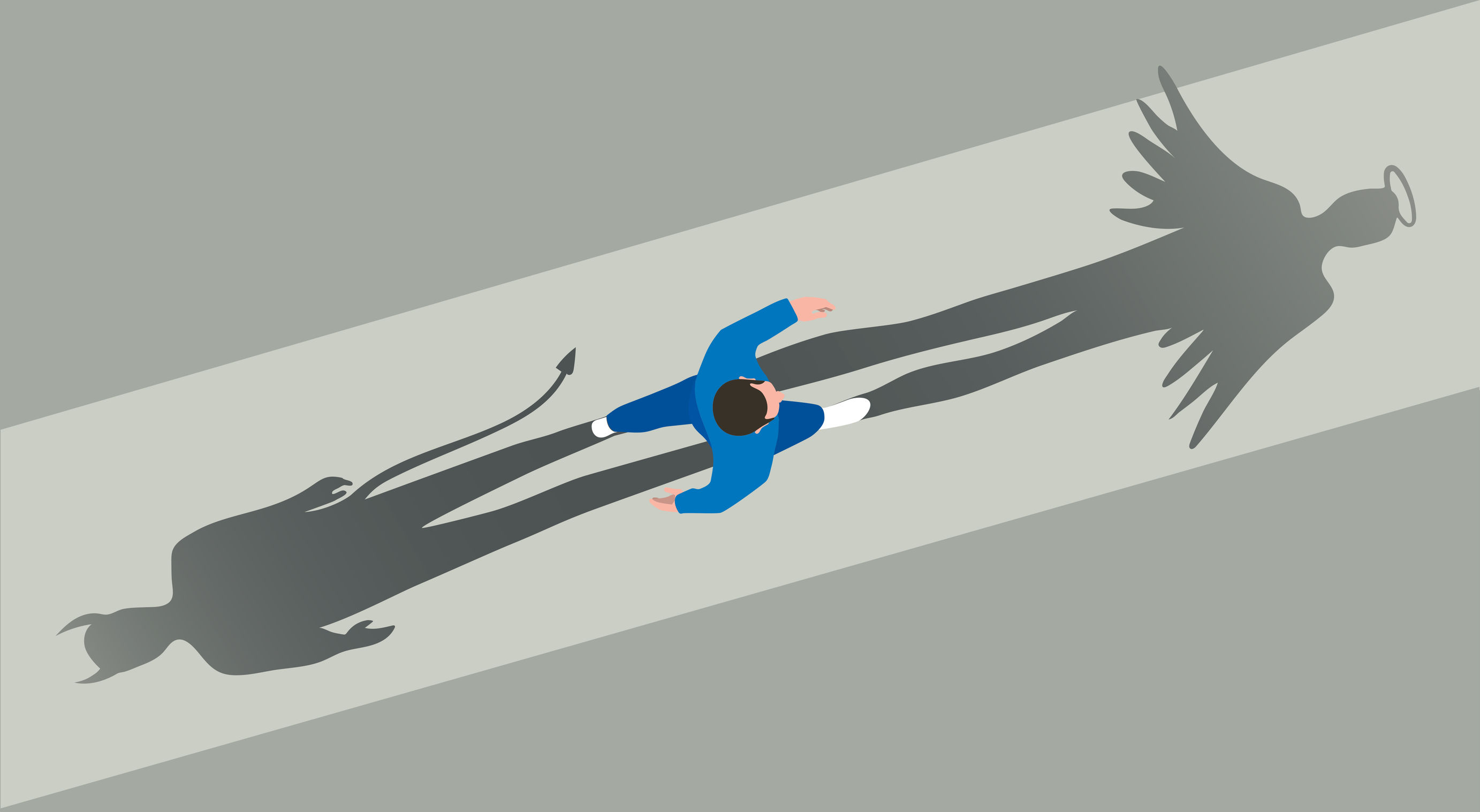

Whether it’s a year where something we once knew as “normal” was part of our reality, or during an unprecedented and unimaginable year of a global pandemic, the abiding management question for all small business owners is always valid: “What’s the best use of my time right now?” And at no other time of the year are we more time-management challenged than in December. Anyone who has contemplated forsaking the perceived, if not real, security of employment to start a small business has come face-to-face with and overcome the greatest of all business challenges: the fear of failure. Countless would-be entrepreneurs have discontinued their self-employment pursuits for fear of losing too much – the risk being just too great. Everybody knows that.

Anyone who has contemplated forsaking the perceived, if not real, security of employment to start a small business has come face-to-face with and overcome the greatest of all business challenges: the fear of failure. Countless would-be entrepreneurs have discontinued their self-employment pursuits for fear of losing too much – the risk being just too great. Everybody knows that. “This is for one of those customers from hell.”

“This is for one of those customers from hell.” “No problem.”

“No problem.”